Exaud Blog

Blog

Blockchain Strategy: The 5-Question Framework for Product Leaders

Don't build on blockchain just because it's trendy. Use Exaud's 5-question framework to strategically decide if your product truly needs distributed ledger technology or a traditional stack.Posted onby ExaudMost product teams do not have a blockchain problem, they have a business, data, or UX problem. This article is designed to help founders and product leaders decide when blockchain is actually the right foundation for a new product and when a well‑built traditional stack is the smarter move. It aligns closely with Exaud’s positioning in custom blockchain development and consulting for exchanges, DeFi, and gaming, plus its track record with fintech and Web3 clients in Europe and North America.

What blockchain really brings to the table

Blockchain is a type of distributed ledger that lets multiple, independent parties share and validate a common record of transactions without relying on a single central authority. Data is grouped in blocks, cryptographically linked, and replicated across nodes, making it extremely resistant to tampering once confirmed. In practice, this means blockchain is strongest when your product needs shared, tamper‑resistant data, real digital ownership, and minimized intermediaries across several stakeholders, not just a “secure database”.

A decision framework: 5 questions to ask before using blockchain

Before adding “Web3” to your roadmap, evaluate your concept using the following five questions. If you do not receive multiple strong affirmative responses, blockchain is likely not the optimal core technology.

1. Do multiple independent parties need a shared source of truth?

Blockchain shines when you have several organizations or users who do not fully trust each other, but still need to read and write to a shared ledger.

Examples include:

-Cross‑border payments between banks and fintechs

-Multi‑exchange trading infrastructure in DeFi

-Marketplaces or platforms where buyers, sellers, and service providers all care about the integrity of transactions

If your use case lives entirely inside a single company or app that you control end‑to‑end, you can usually achieve the same goals with a central database plus solid access control.

2. Is integrity and auditability more important than raw performance?

Public and many permissioned blockchains are optimized for integrity and transparency, not maximum throughput or ultra‑low latency. Consensus, validation, and replication add overhead compared with a centralized database or in‑memory store. If your product’s primary value is that no one can secretly rewrite history, for example, in financial settlement, governance, or audit‑heavy flows, this trade‑off makes sense. If you need instant responses, complex queries, or real‑time analytics at scale, you may be better served with traditional infrastructure plus strong logging.

3. Do you want to remove or minimize intermediaries?

One of blockchain’s most compelling promises is reducing the need for trusted middlemen. Smart contracts can encode rules and automate operations that would otherwise require clearing houses, escrow services, or centralized platforms. DeFi is a clear example: lending, borrowing, and trading can happen peer‑to‑protocol instead of going through a bank or broker, as seen in Exaud’s work with Wellfield and other DeFi players. If your value proposition is built around cutting out middle layers, increasing transparency, or enabling direct peer‑to‑peer interaction, blockchain is likely worth serious consideration.

4. Are digital assets and real user ownership core to your product?

If your product revolves around tokens, in‑game items, NFTs, or other digital assets that users need to truly own and transfer, blockchain is a natural fit.

Use cases that benefit include:

-Crypto exchanges and tokenized assets

-Web3 gaming with tradeable in‑game items

-Loyalty, ticketing, or membership systems where users hold assets in their own wallets

In these scenarios, having assets on‑chain enables secondary markets, composability with other protocols, and user‑controlled storage, all of which are hard to replicate with a purely centralized architecture.

5. Do you need transparency and verifiable behavior by default?

For some products, proving what happened, and when , is a feature, not a by‑product. Voting, governance, and audit‑heavy financial applications benefit from a ledger where every action is timestamped and verifiable. If regulators, partners, or users need to verify transactions independently, the transparency of a blockchain can build confidence and reduce disputes. If those stakeholders are happy to trust your internal logs and reports, a conventional system with strong observability may be enough.

Strong blockchain fit: concrete product scenarios

The following product types rarely view blockchain as merely “nice to have.” In many cases, it is a central component of the value proposition.

Crypto exchanges, DeFi platforms, and trading infrastructure

Decentralized exchanges, liquidity protocols, yield platforms, and tokenized investment products depend on transparent, programmable rules and direct control over assets.

In these systems, smart contracts enforce:

-How trades clear and settle

-How collateral is handled

-How rewards and fees are distributed

Exaud’s work as a technology partner for Wellfield’s DeFi innovation hub in Portugal reflects the kind of deep engineering and blockchain expertise required to design these systems safely.

Web3 gaming and digital economies

When games or digital experiences want to offer true asset ownership and open economies, blockchain is a powerful building block.

Typical features include:

-Tokenized in‑game items and currencies

-Player‑owned inventories that survive beyond a single title

-Marketplaces where players buy, sell, and lend assets

For studios, the challenge is implementing this without breaking the game’s balance or UX. A partner with experience in both blockchain and complex software products can help design economies that are sustainable, fair, and technically sound.

Voting, governance, and multi‑stakeholder decision systems

Blockchain‑based voting systems and DAOs aim to ensure that votes cannot be quietly changed or discarded, while still protecting privacy and usability.

This matters in contexts such as:

-Corporate and shareholder governance

-Protocol governance in Web3 projects

-Multi‑party consortia where decisions impact several stakeholders

Here, blockchain supports trust and transparency, while a carefully designed application layer handles UX, identity, and access control.

Weak blockchain fit: where a traditional stack wins

Equally important: here are common situations where blockchain often adds complexity without enough upside.

Internal line‑of‑business tools

Internal dashboards, back‑office systems, and departmental apps owned and operated by a single company usually do not need distributed consensus or tokenization.

For these use cases, modern cloud platforms and a solid architecture will give you better:

-Performance and scalability

-Operational simplicity

-Developer productivity

You can still adopt best practices inspired by Web3, such as clear audit trails or strong cryptography, without using blockchain itself.

Simple CRUD applications with clear ownership

If your product is essentially “create, read, update, delete” over data that has a clear owner and no contentious trust model, a traditional database is a better default.

You can layer on:

-Role‑based access control

-Encryption at rest and in transit

-Versioning and backups

All of this delivers integrity and security without the overhead of a distributed ledger.

“Marketing blockchain” projects

If the most compelling argument for blockchain in your project is “it sounds innovative” or “competitors are doing it”, you are likely dealing with a reputational or positioning question, not a technical requirement. In these cases, focusing on usability, performance, and measurable outcomes will do more for your product than adding a technology your team is not ready to maintain. A good technical partner will help you challenge the brief instead of blindly implementing a buzzword.

Making the right choice: Public vs. permissioned blockchains

Once you are confident that blockchain fits, the next decision is which kind of blockchain to build on.

Public blockchains

Public networks like Ethereum and other Web3 ecosystems are:

-Open for anyone to join

-Highly transparent and censorship‑resistant

-Well suited for consumer‑facing DeFi, NFTs, and open protocols

They are often the right choice when you want maximum composability and ecosystem reach, especially if your users are global and already active in crypto.

Permissioned and enterprise blockchains

Permissioned solutions, such as Hyperledger‑based networks, restrict participation to approved entities. They are often used in:

-B2B consortia and supply chains

-Financial institutions requiring strict compliance

-Scenarios where data privacy and governance are critical

This model offers more control over data visibility, performance, and regulatory alignment, particularly attractive for enterprises in Europe and North America operating under banking, securities, or data‑privacy rules.

Designing a low‑risk blockchain pilot

Even when blockchain is the right choice, the safest path is not a “big bang” release, but a tightly scoped pilot with clear success criteria.

1st Step: Narrow the use case

Pick one high‑impact but contained process or asset, such as:

-A single DeFi product (e.g. lending or a specific trading pair)

-One class of NFT or in‑game asset

-A specific voting or governance flow

By limiting scope, you reduce risk and can iterate faster.

2nd Step: Define success metrics up front

Agree on how you will evaluate success before writing code, for example:

-Reduction in settlement disputes or reconciliation time

-Increased user retention or on‑chain activity

-Improved transparency for partners or regulators

This focuses your engineering work on outcomes instead of features.

3rd Step: Architect for off‑chain and on‑chain balance

Not every function needs to live on‑chain. A robust architecture typically:

-Keeps heavy computation and sensitive data off‑chain

-Uses smart contracts for rules that require transparency and immutability

-Integrates with existing backend systems and analytics tools

This hybrid approach is where experienced blockchain engineering teams add real value.

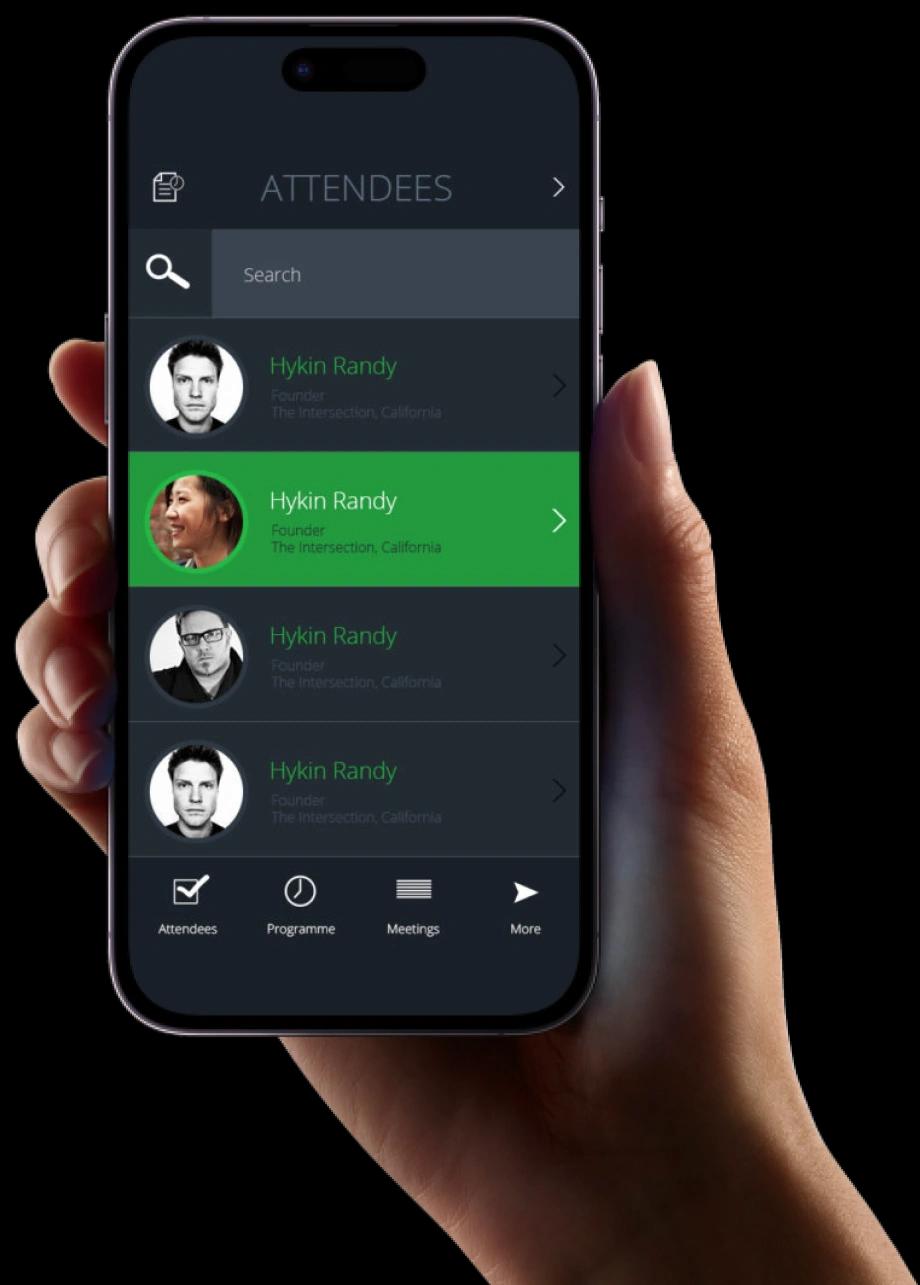

4th Step: Prioritize UX and education

For many users, especially in regulated GEOs like the EU, UK, and North America, UX and clarity determine whether a blockchain‑based product gains adoption. Good practice includes:

-Hiding unnecessary Web3 jargon

-Providing clear explanations of risks and security practices

-Offering safe defaults for wallets, keys, and recovery

A seamless experience is essential if you want to reach beyond early adopters.

5th Step: Plan for security and long‑term maintenance

Smart contracts, once deployed, can be difficult or expensive to upgrade, especially on public chains. Your plan should include:

-Code reviews and independent audits for critical contracts

-Ongoing monitoring and incident response processes

-A roadmap for upgrades and protocol governance

Treat blockchain components as core infrastructure, not side projects.

Why work with a specialized blockchain partner

Selecting an appropriate blockchain architecture and executing it securely requires more than introductory Web3 knowledge. It demands deep software engineering and DevOps expertise, coupled with an advanced understanding of smart contracts, Web3 tooling, and security. Additionally, successful implementations require experience integrating blockchain components into broader product ecosystems, ensuring that on-chain and off-chain systems operate seamlessly together. Exaud positions itself precisely at this intersection, combining custom software development with specialized blockchain and DeFi expertise. As a trusted technology partner for fintech and Web3 companies such as Wellfield, Exaud supports product teams across Europe, North America, and other mature markets in validating whether blockchain is truly necessary, selecting the most appropriate public or permissioned infrastructure, and designing secure, scalable, and compliant solutions that are tailored to their specific sector and regulatory environment.

Key takeaway for founders and product leaders

Use blockchain when you must share a trusted record among independent parties, encode transparent rules, or enable digital assets that users genuinely own. Conversely, rely on traditional architectures when you control the data, trust model, and ecosystem.

Ready to Validate Your Product Strategy?

If you are uncertain whether blockchain is the right foundation for your product, or if you need to design a secure hybrid architecture that balances on-chain immutability with off-chain performance, now is the ideal time to consult a specialist partner. Exaud combines deep software engineering expertise with specialized Web3 knowledge in regulated markets. We help product teams transform “maybe we should use blockchain” into a clear, actionable, and compliant roadmap or a deliberate strategic “no.” Contact our blockchain experts today to schedule a project validation session.

Related Posts

Subscribe for Authentic Insights & Updates

We're not here to fill your inbox with generic tech news. Our newsletter delivers genuine insights from our team, along with the latest company updates.