Exaud Blog

Blog

Interview with Exaud’s General Manager: Insights and Trends from MoneyLIVE Europe Conference

Exaud’s GM attended MoneyLIVE Conference, sharing insights on FinTech trends and innovations. Explore the interview for firsthand knowledge at the forefront of the financial industry. Posted onby Exaud

Exaud’s General Manager, Georg Tubalev, attended

MoneyLIVE Europe Conference and

is now sharing insights on trends and innovations shaping the future of

FinTech.

What were the main trends discussed at the MoneyLIVE Europe Conference in

Amsterdam?

This conference brought up some interesting points. Here are a few

highlights:

- The European Payment Initiative (EPI) caught our attention with plans for a pan-European digital wallet, taking on major players like Visa and Mastercard. It’s a bold step towards a more unified digital payment landscape in the EU.

- The ongoing development of the Digital Euro highlights the EU’s commitment to advancing digital currency frameworks, marking a strategic shift towards embracing digital currencies.

- Discussions on instapayments explored their expansion beyond SEPA, revealing how real-time transactions are becoming a game-changer in the broader financial landscape.

- OpenBanking 2.0 took the spotlight, with a focus on the implications and innovations of the upcoming phase of open banking. This highlighted significant changes in how banks operate, driven by technology.

- Another notable topic was the ongoing decline of cash in Europe, especially with Norway’s 97% prevalence of cashless transactions. This trend signifies a broader shift towards digital transactions, diminishing the role of physical currency. The conference provided valuable insights into these transformative trends, shaping the financial industry’s trajectory in Europe.

Can you give a brief overview of key insights or takeaways that could

influence Exaud’s business strategy?

Firstly, there’s a clear call for significant updates in banking infrastructure, potentially creating opportunities for companies in the software development industry. Then, there’s discussion around the European Payment Initiative (EPI), which can lead to an uptick in demand for IT services. As businesses adapt to this new initiative, we see an opportunity for our involvement. Lastly, payments sector in Europe is evolving rapidly, emphasizing the need for software that can truly make transactions frictionless. It sounds like there’s more work to be done in this area, providing a cue for Exaud to step up and offer solutions aligning with this evolving landscape.

Were there notable technologies or innovations highlighted at the

conference relevant to our industry?

There were some game-changing insights at the conference that directly impact our tech landscape:

- Instant Payments are on the fast track of evolution. Businesses and banks need to ensure their operational processes and software stay up to speed because they’re changing rapidly.

- Digital identity platforms are in the pipeline. Staying on the lookout for what’s coming soon in this space is crucial.

- Embedded Finance is grabbing attention and it’s not alone. Several other tech trends are making waves. Exciting times ahead in the tech world.

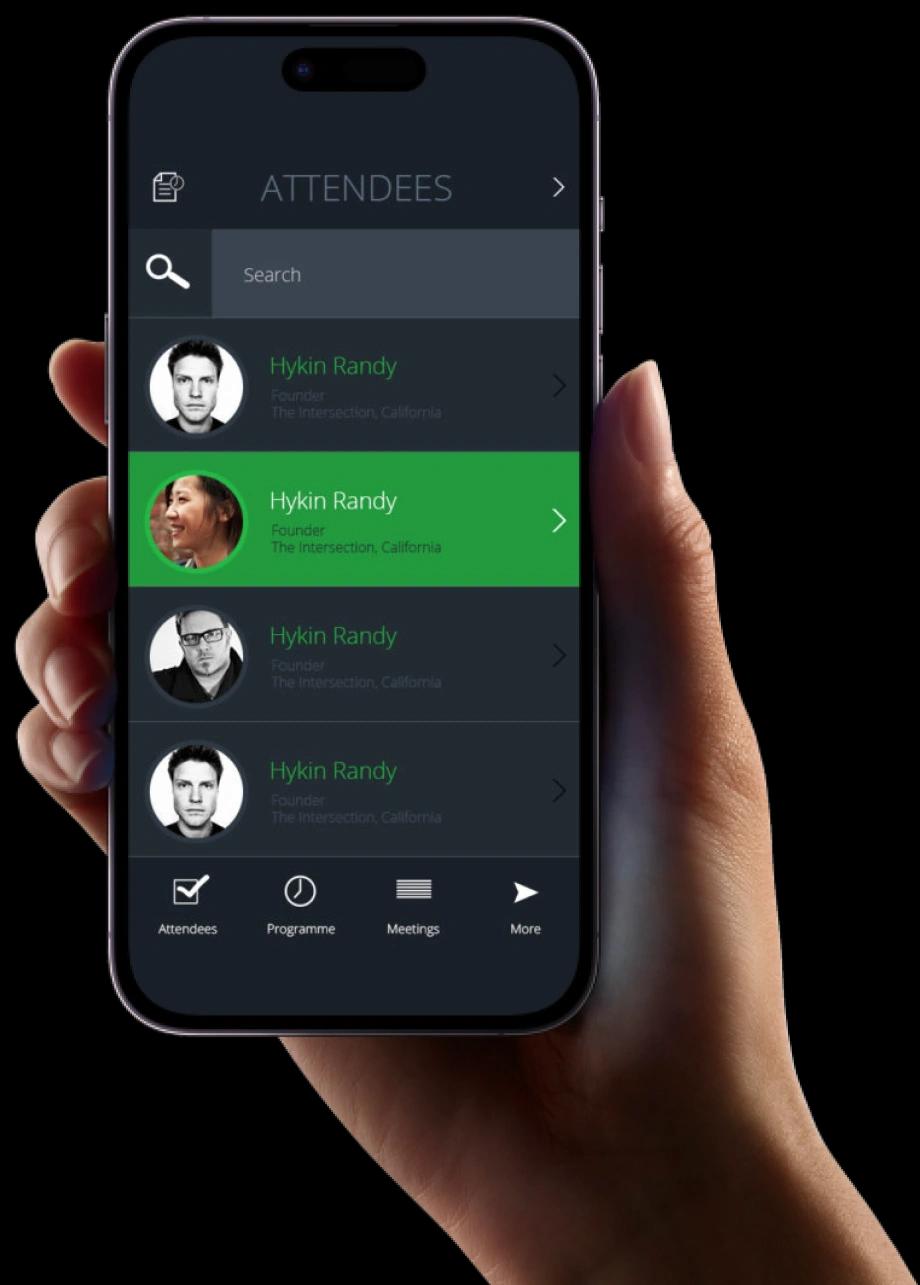

Take a look at a few snapshots.

Related Posts

Subscribe for Authentic Insights & Updates

We're not here to fill your inbox with generic tech news. Our newsletter delivers genuine insights from our team, along with the latest company updates.